Industrial Building Allowance Malaysia Public Ruling

Capital allowance public ruling no.

Industrial building allowance malaysia public ruling. 19 december 2018 director general s public ruling section 138a of the income tax act 1967 ita provides that the director general of inland revenue is empowered to make a public ruling in relation to the application of any provisions of the ita. An industrial building includes a building used as for. Qualifying building expenditure qbe one of the main aspects of the public ruling is the clarification of what constitutes qbe.

27 august 2015 page 1 of 22 1. 8 2016 date of publication. Malaysia public ruling on industrial building capital allowances on 23 november the inland revenue board of malaysia issued public ruling pr no.

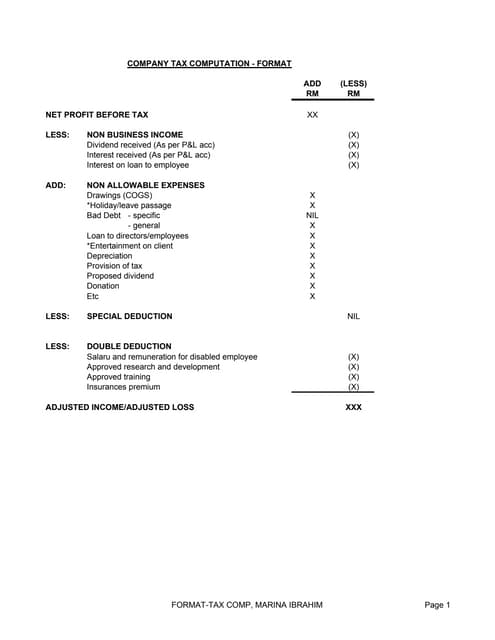

8 2016 to explain the types of buildings that qualify as industrial buildings under schedule 3 of the income tax act 1967 ita for capital allowance purposes. It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and procedure that are to be applied. A ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board of malaysia.

C tin mining. Inland revenue board of malaysia computation of capital allowances public ruling no. B timber the extraction of timber from a forest.

A factory warehouse a dock wharf jetty working a farm mine airport a hotel registered. Inland revenue board of malaysia industrial buildings public ruling no. 3 2018 to explain the tax treatment in relation to qualifying building expenditure qbe and the computation of industrial building allowances iba.

12 september 2018 page 1 of 27 1. A ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new. Objective the objective of this public ruling pr is to explain the types of buildings that qualify as industrial buildings under schedule 3 of the income tax act 1967 ita.

The pr refers to schedule 3 of the income tax act 1967 the act on capital allowances. Business of a person carried on in malaysia which consists of a building and construction the construction of any works roads structures and buildings. On 23 november 2016 the inland revenue board of malaysia irbm issued public ruling pr no.

6 2015 date of publication. Computation of industrial building allowances public ruling no. Relevant provisions of the law.

Qbe is capital expenditure incurred by a person on the cost of. Objective the objective of this public ruling pr is to explain the tax treatment in relation to qualifying building expenditure qbe and the computation of industrial building allowances iba. The pr provides greater guidance on the types of buildings that qualify as industrial buildings for capital allowance purposes.

Constructing the original building which would include the cost of constructing. The inland revenue board of malaysia has issued public ruling no. 7 2018 date of publication.

8 2016 industrial buildings part 1. Qe for purposes of industrial building allowance is the cost of construction of buildings or structures which are used as industrial buildings. Objective the objective of this public ruling pr is to explain a tax treatment in relation to qualifying expenditure on plant and machinery for.

In the case of a purchased building the qe is the purchase price. 7 2 machinery or plant used in certain industries. 8 oktober 2018.

.jpg)