Incentive Under Section 127

Business income income arising from services rendered by an ohq company to its offices or related companies.

Incentive under section 127. I also dunno what is that. Show posts by this member only post 2. Junior member 175 posts joined.

Claim incentive under section 127 which one to choose. So unless a minister has statutorily exempted you from certain taxes it s probably not relevant to you. Apr 16 2018 04 47 pm.

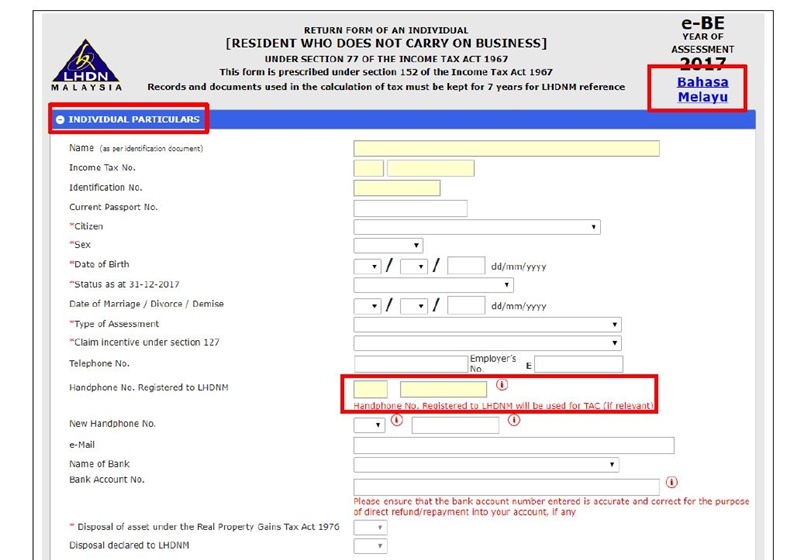

If you re curious about the entitled to claim incentive under section 127 the dropdown list allows you to claim under paragraph 3 a or 3 b which is listed below. A incentive for ohq an approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources. Paragraph subsection paragraph subsection not relevant.

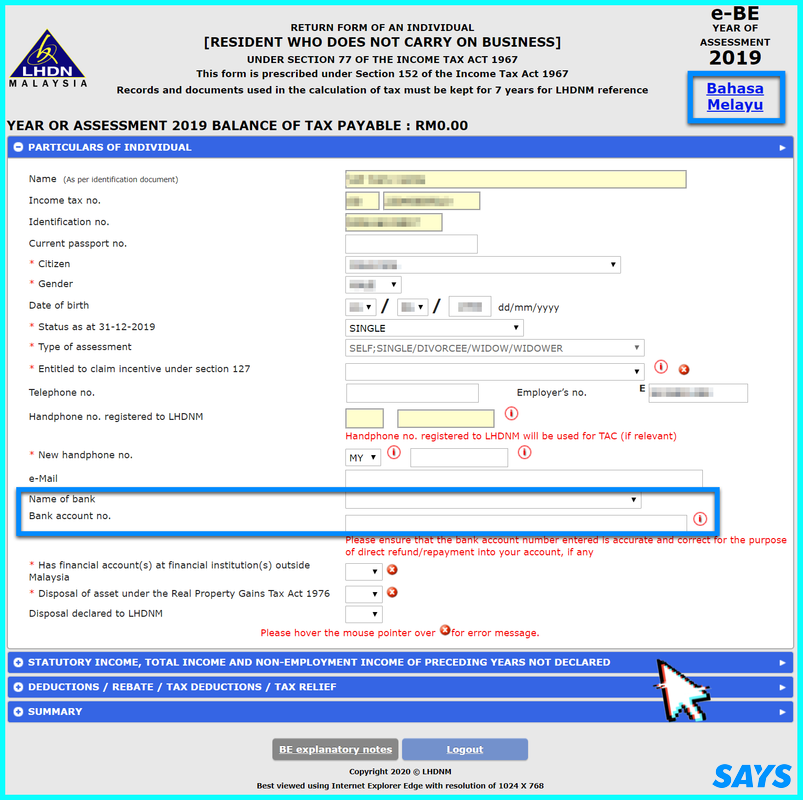

There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. A non application or mutual exclusion provision is a common feature in exemption orders and income tax rules granting tax incentives. There had been some confusion as to which types of section 127 exemptions would exclude taxpayers from claiming incentives under specific gazette orders made under the income tax act 1967.

A8a entitled to claim incentive under section 127 refers to incentives for example exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. 1 paragraph 127 3 b of ita 1967. If you are not entitled to such exemptions choose tidak berkenaan.

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.