Importance Of Retirement Planning In Malaysia

For those who have neglected doing so in the past i say better late than never.

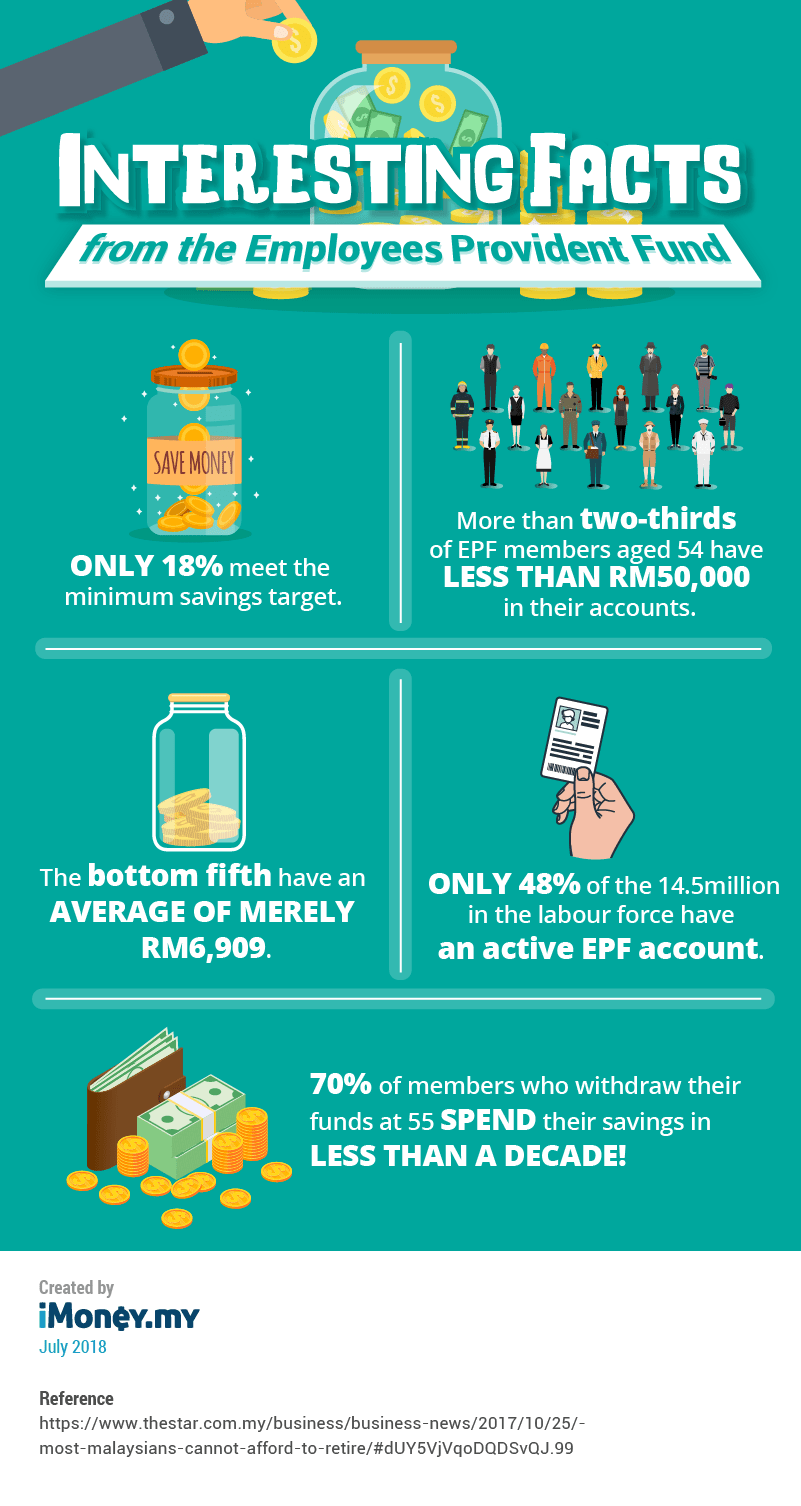

Importance of retirement planning in malaysia. But before you can start working towards achieving your retirement goals you ll need to determine the amount you actually need. Currently the retirement plans available in malaysia such as employee provident fund epf. How much is enough and what must i do to get that amount.

1 retire in malaysia. In retirement planning it is not enough for malaysians to ensure that they are able to generate wealth. The usual rule of thumb for budgeting to save is to save 20 of your income but this is surely not enough when it comes.

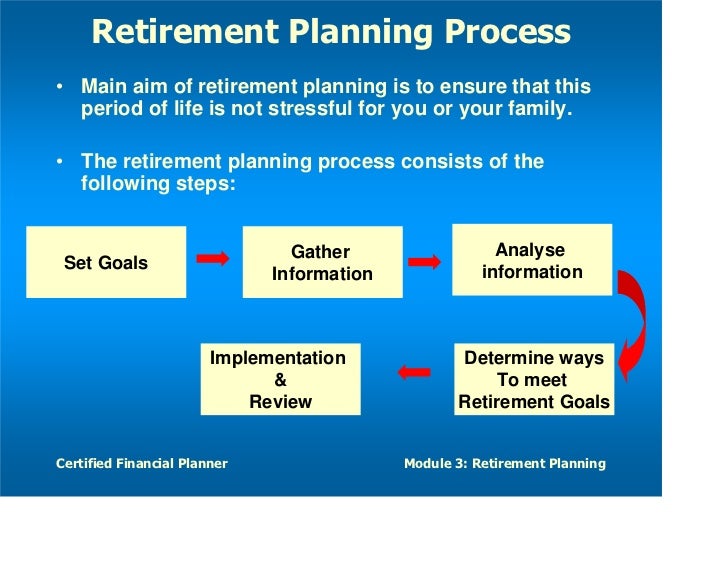

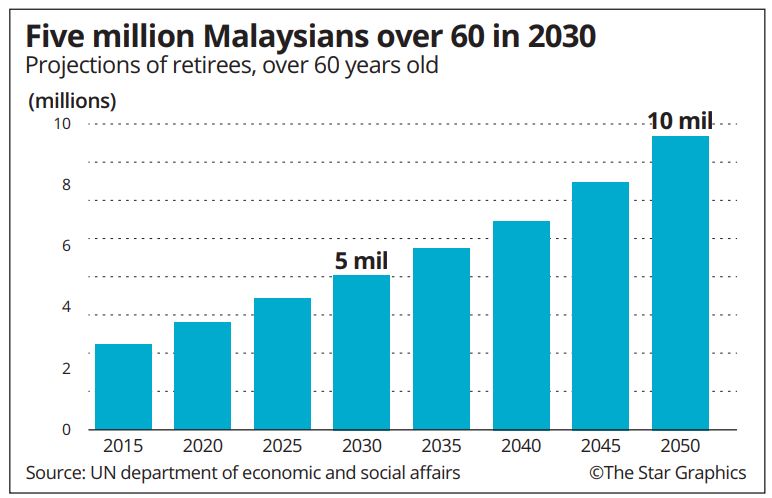

Start putting a plan in motion right away so that when the time comes you can enjoy your golden years with a lifestyle that you deserve. Inflation in malaysia averages between 2 to 3 per year. The importance of retirement planning is a call in malaysia due to fast ageing population in the country.

They also need to preserve it so it can be passed on to the next generation. To do this they will need to have well crafted regularly updated estate planning documents regardless of the size of their assets. Abstract this paper aims to discuss the important of islamic retirement planning in malaysia.

But don t let that stop you. The important of islamic retirement planning in malaysia masri azrul bin nayan 1 dr. The rule is to start planning for your retirement the moment you have gained a stable income because the earlier you start the more funds you will have by the age of 55.

The best retirement plan in malaysia may seem like a mind boggling topic simply because it is difficult to foresee what our future holds and how much we will be making or needing 20 years from now. Manage the inflation risk and outlive your retirement nest egg. However with the rising cost of living and a longer lifespan for malaysians coupled with increasing inflation planning for our golden years aka retirement is a more crucial than ever.

The retirement planning part is important. Firstly because of the age issue and secondly because most malaysians need to save more to cater for the increasing cost of living especially medical costs. We take 3 as conservative estimate for computation for living costs in retirement planning.

Yusuf haji othman 2 1 2 zu µo v µo o udµ ìu zz v v vo ou hv à ç hv d u malaysia. However bear in mind this could very likely be higher due to your personal retirement lifestyle living costs in malaysia. The first reason you need to kick start your retirement planning is the simple fact that people are now on average living longer than ever before.

To do so you ll have to do some basic calculations based on your current expenditure whilst factoring in inflation from now. This is measured by the cpi consumer price index indicator from department of statistics of malaysia. A longer life means you ll need more retirement funds saved to continue to live off of.

As a part of islamic wealth management islamic retirement planning can be considered as still new in malaysia.