How To Pay Gst Malaysia

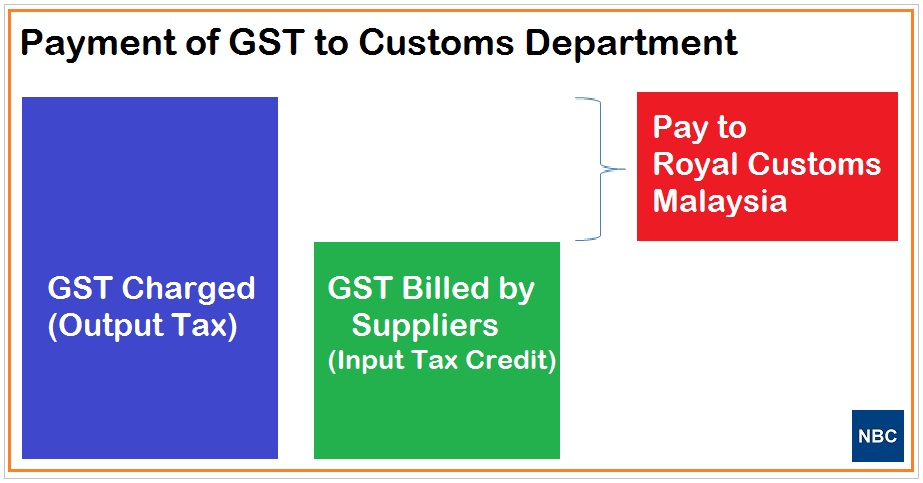

How much to pay.

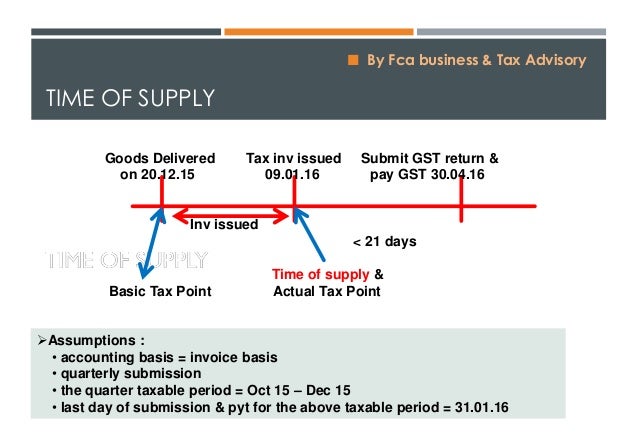

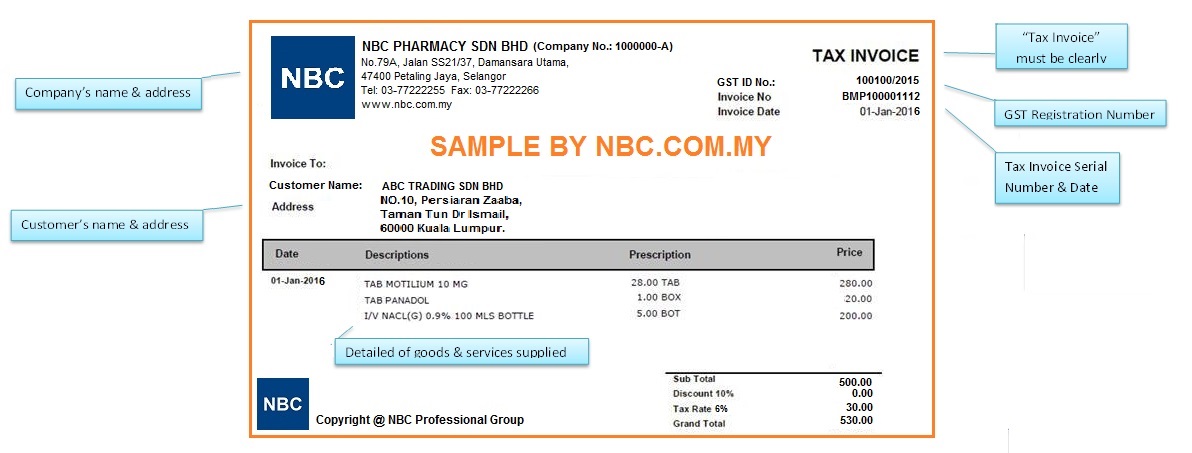

How to pay gst malaysia. Bank portal payment online through appointed banks agent banks by debiting taxpayers account. To calculate malaysian gst at 6 rate is very easy. For login you need to fill your username and password.

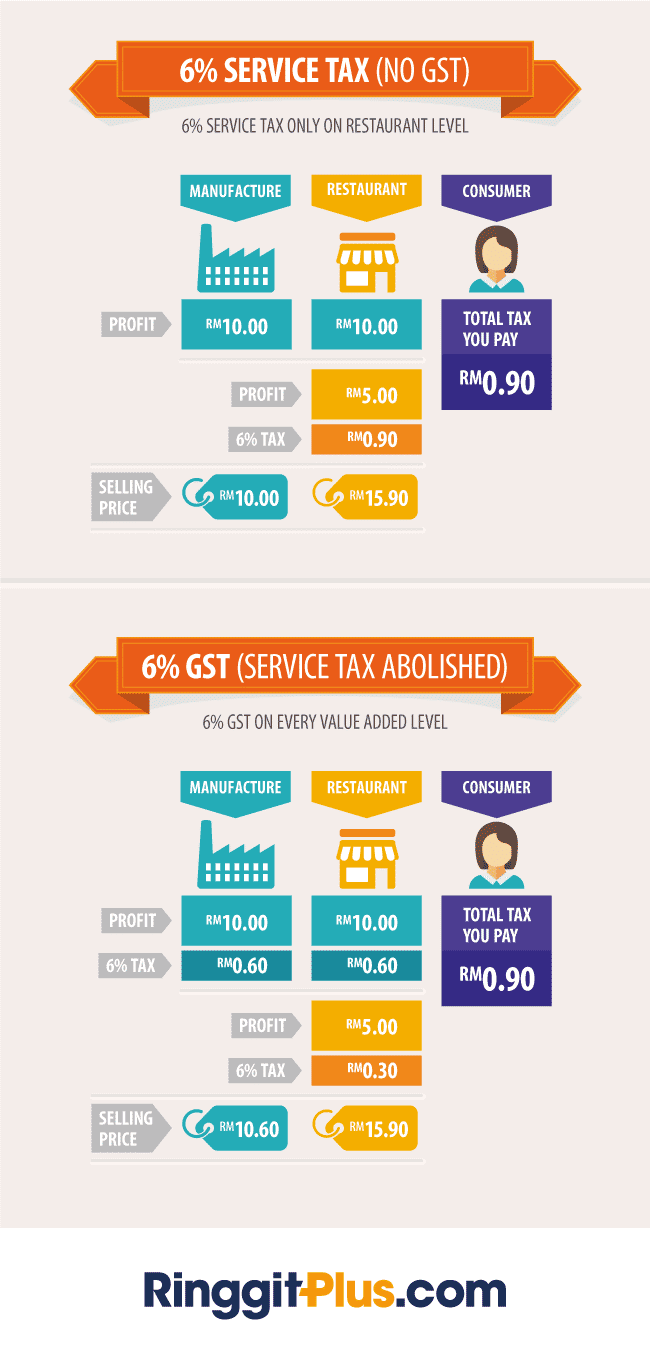

If the recipient is a taxable person he is entitled to claim input tax on the services if the imported services are used for making taxable. Here you will get three payment methods to make the payment i e. 300 0 06 18 gst amount.

Please provide the following information in the payment slip. Existing gst registrants are automatically ceased to be liable for registration under the gst when the gst act 2014 is repealed. After login you need to go services payments create challans options.

Self service terminal automated tele machine atm. When services are imported from outside malaysia and supplied to a recipient in malaysia being taxable supplies if made in malaysia the recipient of the supply shall account and pay gst if such imported services are for the business purposes and consumed in malaysia. Just multiple your gst exclusive amount by 0 06.

After filling the selected amount and payment method click on the generate challan option. For both gst and non gst registered persons the registration for the sst has to be done online through mysst system. They are not required to apply for deregistration but they are required to submit the final gst return within 120 days from the act being repealed.

How to calculate malaysian gst manually. 300 is gst exclusive value. In malaysia the goods and services tax gst was introduced on april 1 2015.

Paying gst in malaysia. To get gst inclusive amount multiply gst exclusive value by 1 06. To pay gst online first of all you need to login to the gst portal.