How To Calculate Epf Wages

Wages subject to epf contribution.

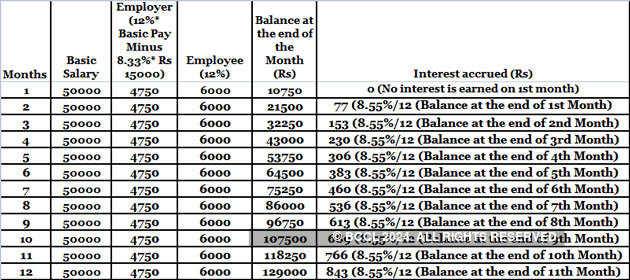

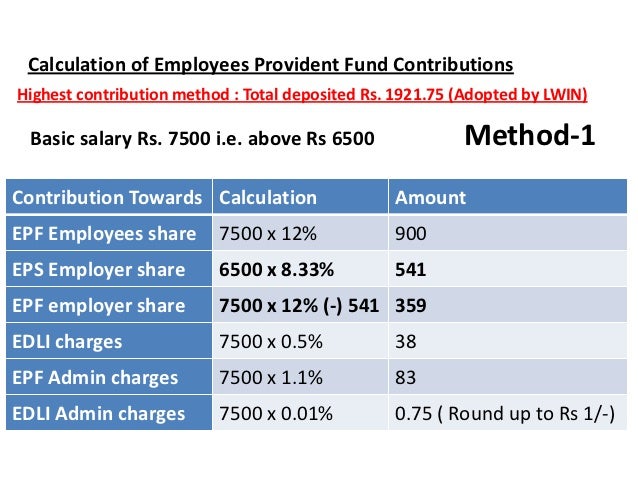

How to calculate epf wages. This amount is calculated each month. How to calculate epf contribution. Pf admin charges calculation formula total epf wages x 0 50 for example if the total epf wages of an establishment in a month is 652861 rs then the pf admin charges calculation is as follows 652961 x 0 50 3264 305 3265 round figure.

Employees monthly basic salary dearness allowance. Interest on the employees provident fund epf is calculated on the contributions made by the employee as well as the employer. Wages for half day leave.

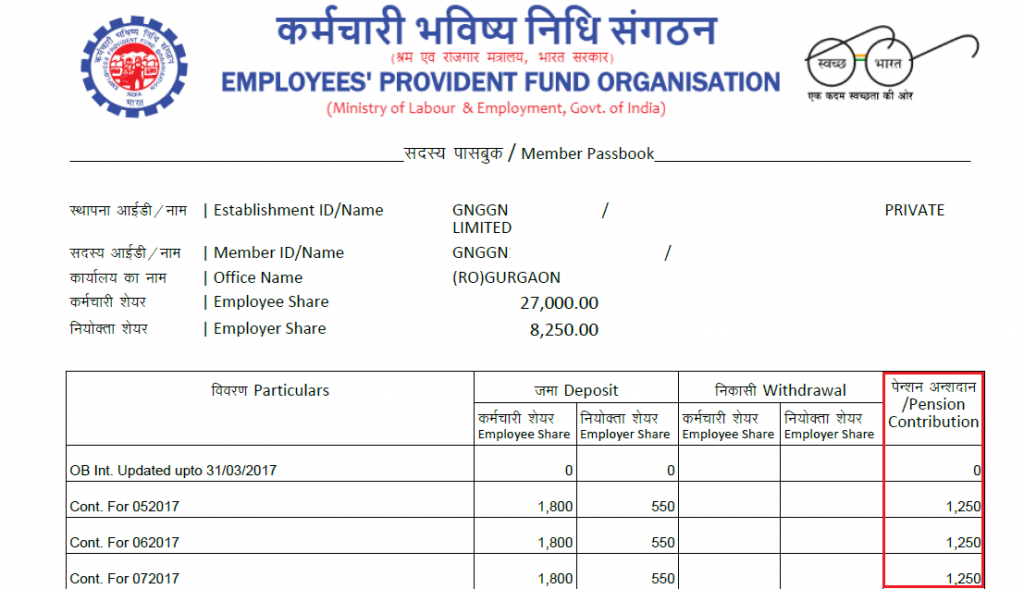

Rs 15000 employee contribution toward epf will be 12 15000 rs 1800. In general all payments which are meant to be wages are accountable in your monthly contribution amount calculation. The employees provident fund epf calculator will help you to calculate the amount of money you will accumulate on retirement.

Wages for study leave. On 15000 pf deduction will be 1800 rs and the same amount will be paid by the employer also. Wages for maternity leave.

Current epf interest rate is 8 65. When the employee s income is below or equal to rs 15 000 then the pf amount of salaried employers is calculated as follows. As per epf rules the pf amount will be calculated at a limit of 15000 rs basic da.

15 000 is the benchmark salary for the employees in the current scenario let us look at the 1st scenario in which the employee salary is below 15 000 both the employer and the employee needs to make contribution towards their epf and if the sum of basic pay and dearness allowance is less than 15 000 the employee contribution is 12 towards the provident fund while the employer contribution is divided into following parts. Your present age and the age when you wish to retire. Other payments under services.

Employee s epf contribution as a of salary generally 12 employer s epf contribution as a of salary generally 3 67 once you provide these inputs the epf calculator does all the hard work for you and tell you how much epf corpus is accumulated by retirement. But if your employer wants to pay pf for more than 15000 rs then they can do that but it is their choice. Contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da.

How to use it to arrive at the retirement corpus you need to enter few details such as.